Are high debt ratios and public spending issues rare in S.Europe?

Such stories are not new in South Europe. Indeed it is typical of Southern European economies that are quite different from their Northern European cousins. Spain's woes are similar with a real estate bust, soaring public deficits and unemployment etc amongst a motley of reasons have caused S&P to issue a downgrade with a negative outlook.

Why are these rating downgrades being discussed in much detail?

Simple. Because of the impact it will have on Greece's banking sector and the ensuing ramifications for Greek economic stability that will serve as harbinger of what is in store for Portugal, and Spain. While media comparisons and dark mutterings about the debts of UK, Japan and US abound, the fears of a contagion are at best overblown. But the implications for Greece are serious because,

In international capital markets and specifically in money markets, bonds and in particular, government bonds tend to be used as a collateral to fund money market operations. For instance, if Greece cannot use bonds as collateral, then Greek banks lose upto EUR 17 bn in funds (Source: Risk.net). For example: The National Bank of Greece (NYSE: NBG) uses Greek Govt bonds for 45% of its ECB repos. Get the picture? it is worrisome if the domino indeed sets off as the solutions are unpalatable and in cases impossible to implement.

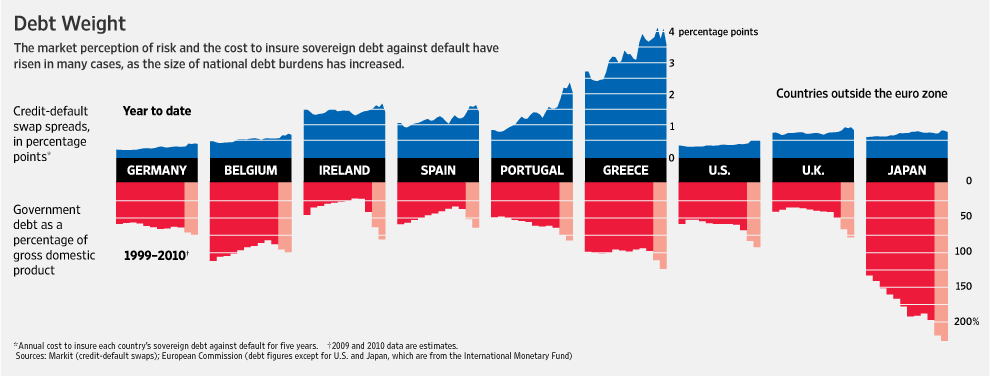

It is now generally agreed that even ECB's relaxed rules allowing BBB- debt as collateral might not be enough to save Greece. As Roubini noted, "This might be the tip of the iceberg as far as sovereign defaults go". He has a point, public finances have been massively re-leveraged since 2008 as fiscal stimulus, tax cuts and underwriting of private sector losses have pushed deficits sky high across the western world. This has two possible outcomes if not reversed a)High Inflation b) debt (and default)

Ofcourse, the 'doom' delphi is correct about the twin outcomes. However, as I said in Part I, this issue has to do more with the internal dynamics of the Eurozone rather than some worldwide phenomenon. UK, US are another story.

Is cutting public services or reducing spending by 9% as bandied around the solution?

Well, the argument that spending needs to be cut is correct. It is at best a partial remedy. As one Greek expat in the US noted in the NYTimes, cuts to spending need to be accompanied by basic changes to the structure of the Greek economy as I said earlier. Especially structural changes that boost the competitiveness of the Greek Economy are critical such as removing the stranglehold of family businesses and boosting entrepreneurship. Taxing rationally would do good as well. The current taxation regime is ridiculous as is enforcement.

Some solutions floating around and my views:

Allow Greece to exit the Euro: While not impossible, it will be a horrible process with bad consequences. Technically, Greece could withdraw from the EMU and as a result from the EU and issue the Drachma again. But with 300 bn in USD and EUR denominated debt, the ensuing pressure on the Drachma and rising interest rates would be too hard to manage. This would mean 'restructuring' or 'haircuts' with debt partially written down. this would cause even more problems with higher debt leading default in a somber progression

devaluation ----> debt ------> default

Verdict: Best not attempted

Haircuts: Another bad idea in this case. This could turn really bad not only for Greece but for the other 'PIGS' in the pen they might not want to hold any member's debt who is under threat of default. This could lead to capital flight with adverse economic consequences.

Verdict: a big no

Outright Default: This will make Greece a 'debt market pariah' for atleast half a decade or till the time their economy has been significantly restructured to prevent defaults in the future.

Another No

Moratorium with some restructuring: A five-year moratorium on Greek debt repayments would be one solution that can keep investors satisfied at a lower cost coupled with select restructuring. As a commentator said, this would amount to a "soft default" which would offer Greece the timeframe for fiscal consolidations. While it is a default of sorts, the US$ 159 bn aid package and time to accelerate fiscal consolidation and improve economic competitiveness gives everyone the best chance to ensure the mess never occurs again .

That would be crucial to ensure the Euro succeeds as an experiment....

Denmark is one such precedent that comes to my mind...