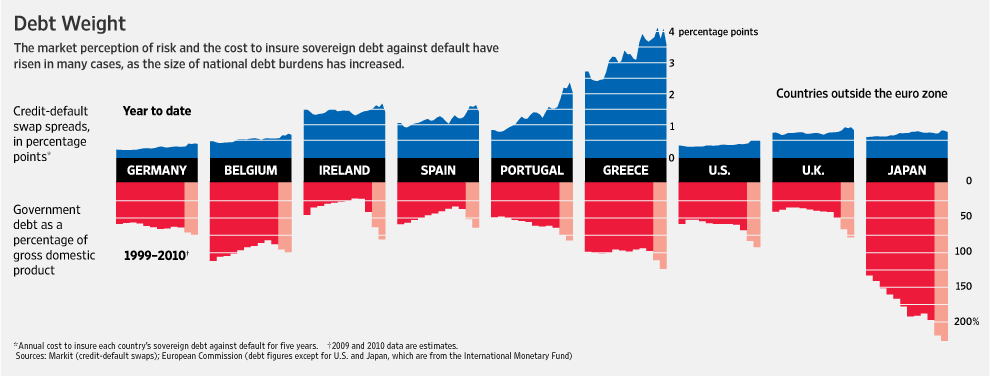

Well you may seen CNBC blaring the news that the spreads between 10 Year Greek Bonds and German Bunds narrowed to 775 basis points from 800 two days back while two year Greek bond yields are at over 13.5% (Bloomberg, Apr.29). Europe is in jitters as Portugal, Spain and even the UK (yes the UK, the pound got walloped in the past few days...). Germany has been locked in an intense debate over bailing out Greece while a EUR 120 bn package is being readied to ensure Greece can stay in the debt markets.

Well you may seen CNBC blaring the news that the spreads between 10 Year Greek Bonds and German Bunds narrowed to 775 basis points from 800 two days back while two year Greek bond yields are at over 13.5% (Bloomberg, Apr.29). Europe is in jitters as Portugal, Spain and even the UK (yes the UK, the pound got walloped in the past few days...). Germany has been locked in an intense debate over bailing out Greece while a EUR 120 bn package is being readied to ensure Greece can stay in the debt markets.So what is happening? Greece is in the throes of a 'default' while Portugal and Spain are finding themselves in hot water and its temperature is rising. Right, Greece first, because what happens in Greece will determine what will happen in Portugal and Spain. This is despite rising fears that a 'debt domino' has already been set off . I disagree on the 'contagion' brouhahaha... despite the IMF's views and S&P's (dubious and discredited in my opinion) chain of ratings downgrades in S.Europe.

I think that, far from being a contagion, it is merely a short period of intense turbulence where Northern Europe led by Germany is essentially saying to the PIGS and especially Greece, that membership of the Euro zone comes with responsibilities.

What Chancellor Merkel is saying is that "Greece, we are going to make an example of you and give you enough of a fright to get the other guys on the line".

Now a little background before we discuss specifics of the Greek crisis,

20 Fiscal Regimes under one Monetary Union: The structural anamoly in the Eurozone permitting 20 odd Fiscal regimes under a single Monetary Union has played a significant role in this mini-crisis. The traditionally weaker and fiscally imprudent Southern European Economies have borrowed as if they possessed Germany's credit rating and borrowed recklessly. The Euro merely provided a convenient front acting as a smoke screen w.r.t debt. This gave a misrepresentation of Eurozone capital markets being homogeneous (not unnoticed, but things happen anyway). As I will mention shortly, the scale of borrowing got hidden from Eurozone firewalls and tragedy has now struck Greece. (Portugal is scampering to enact measures to save itself from further damage...)

A brief background of Greece's woes: For the uninitiated, Greece has traditionally suffered from poor public finances owing to weak spending controls and widespread tax evasions aided by high wages in the bloated public sector. In addition, control of the Greek economy by traditional family businesses have stifled innovation. Further, Greek's populism has ensured labour is amongst the most expensive in Europe affecting pensions, health spending too. Previously Greece could rely on the Drachma to manage debt related issues. However, accession to the Euro has meant that, while poor public policies continued, Greece's predecessor govt to the current socialist regime indulged in skullduggery courtesy (Guess Who?) Goldman Sachs et.al to hide the size of it's ballooning deficits to around Eurozone mandate of 3% of GDP.

(Courtesy: Daniel.S.Mitchell, Cato Institute, December 2009)

(Courtesy: Daniel.S.Mitchell, Cato Institute, December 2009)However, Greece's debt stands at over 300 bn US$ now and deficit has reached close to 14% of Greek GDP while Debt/GDP ratio is over 113%.

To be contd. in Part II

No comments:

Post a Comment